Condo Insurance in and around Columbia

Get your Columbia condo insured right here!

State Farm can help you with condo insurance

Calling All Condo Unitowners!

When considering different coverage options, deductibles, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condominium but also your personal belongings within, including souvenirs, books, sports equipment, and more.

Get your Columbia condo insured right here!

State Farm can help you with condo insurance

Condo Coverage Options To Fit Your Needs

When an ice storm, a blizzard or a hailstorm cause unexpected damage to your townhome or someone is injured at your residence, having the right coverage is important. That's why State Farm offers such great condo unitowners insurance.

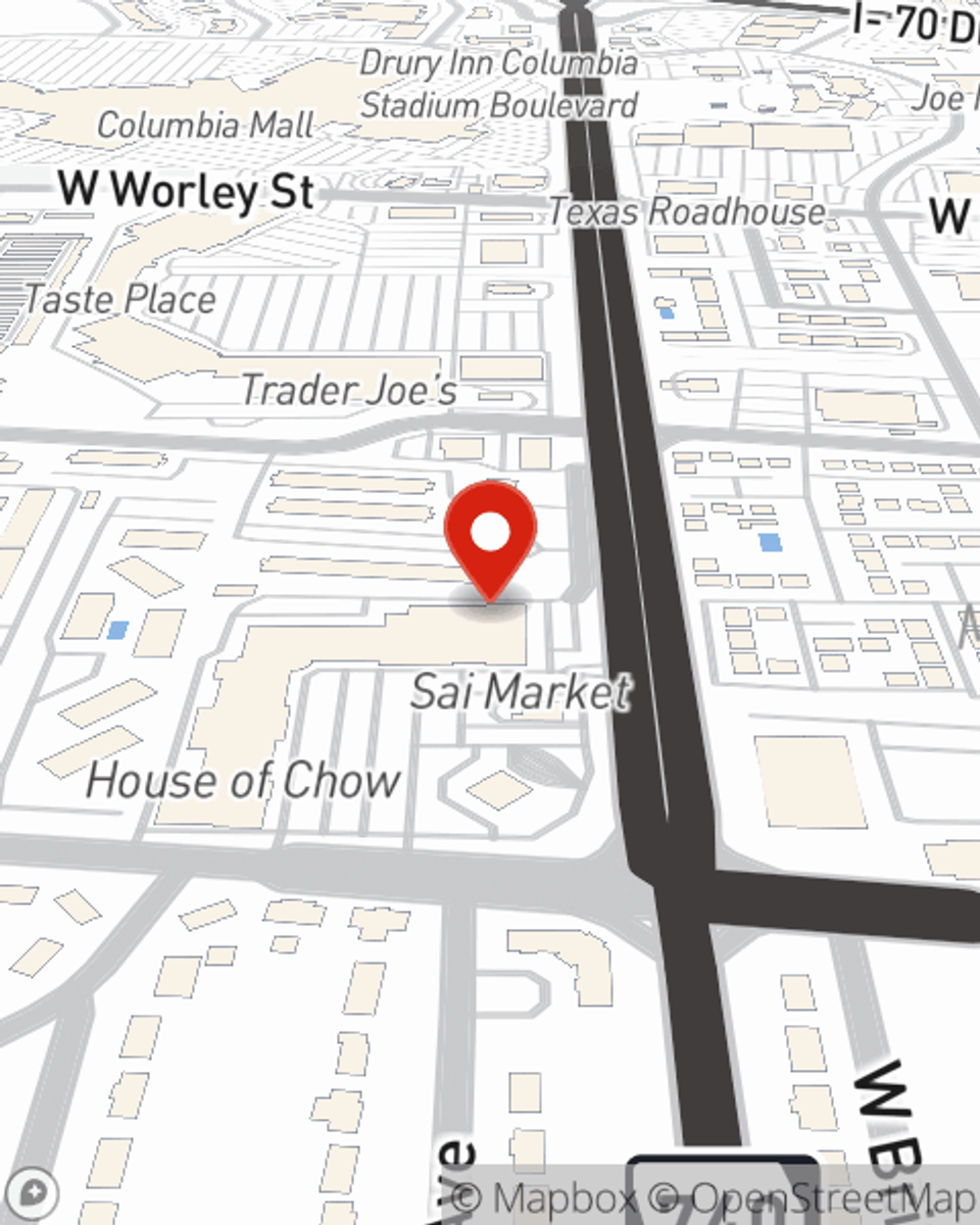

Intrigued? Agent Justin Hahn can help clarify your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Justin at (573) 443-4246 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Justin Hahn

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.